Traditional IRA contributions–Most people are eligible to make contributions to a traditional IRA, but these contributions aren't necessarily tax-deductible.Below are some common examples of ATL deductions. Please consult the official IRS website for more detailed information regarding precise calculations of tax deductions. ATL deductions have no effect on the BTL decision of whether to take the standard deduction or to itemize instead. They include expenses that are claimed on Schedules C, D, E, and F, and "Adjustments to Income." One advantage of ATL deductions is that they are allowed under the alternative minimum tax. Any overall loss from a publicly traded companyĪTL deductions lower AGI, which means less income to pay taxes on.The exclusion under 137 for adoption expenses.IRA contributions, taxable Social Security payments.It is simply AGI with some deductions added back in. MAGI is mainly used to determine whether a taxpayer is qualified for certain tax deductions. The "line" in question is the adjusted gross income (AGI) of the taxpayer and is the bottom number on the front of Form 1040. There are two types of deductions, above-the-line (ATL) and below-the-line (BTL) itemized deductions, which reduce tax based on the marginal tax rate. They help lower tax bills by reducing the percentage of adjusted gross income that is subject to taxes. Other examples include state and local governments not being subject to federal income taxes. In some international airports, tax-exempt shopping in the form of duty-free shops is available. They do not only apply to personal income tax for instance, charities and religious organizations are generally exempt from taxation. Exemptionsīroadly speaking, tax exemptions are monetary exemptions with the aim of reducing or even entirely eliminating taxable income. Any excessive passive income loss can be accrued until used or deducted in the year the taxpayer disposes of the passive activity in a taxable transaction. Passive income generally comes from two places, rental properties or businesses that don't require material participation. Passive Incomes–Making the distinction between passive and active income is important because taxpayers can claim passive losses.

There are many stringent measures in place for dividends to be legally defined as qualified. Qualified Dividends–These are taxed at the same rate as long-term capital gains, lower than that of ordinary dividends. Ordinary dividends are taxed as normal income. Ordinary Dividends–All dividends should be considered ordinary unless specifically classified as qualified. Taxation rules applied are determined by ordinary income marginal tax rate. Long Term Capital Gains/Losses–profit or loss from the sale of assets held for one year or longer. Short Term Capital Gains/Losses–profit or loss from the sale of assets held for less than one year. However, there are certain exceptions, such as municipal bond interest and private-activity bonds. Interest Income–Most interest will be taxed as ordinary income, including interest earned on checking and savings accounts, CDs, and income tax refunds.

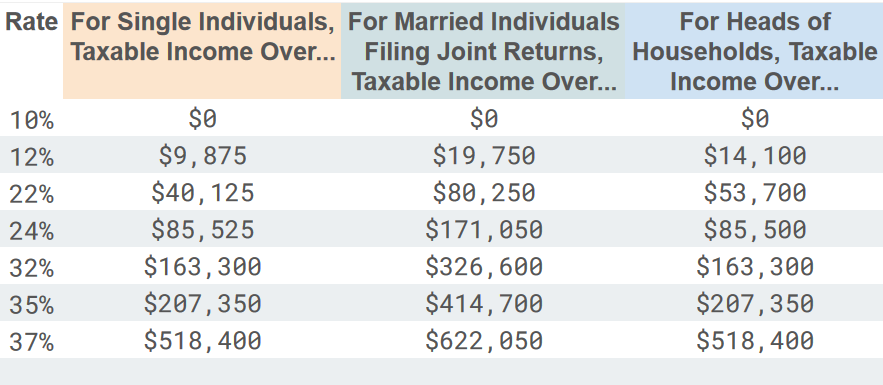

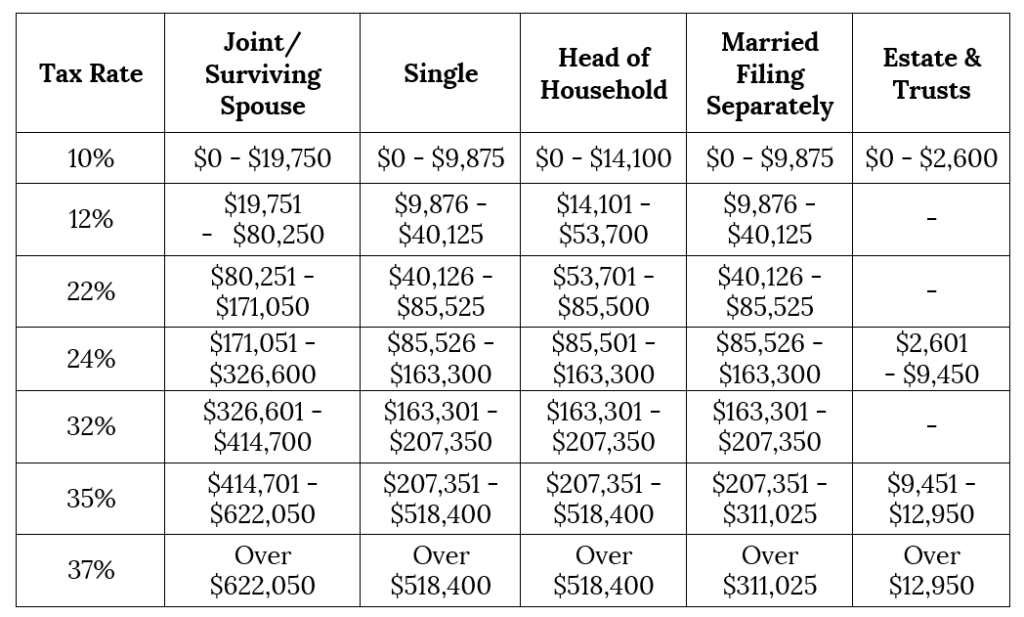

The resulting figure should be the taxable income amount. Taking gross income, subtract deductions and exemptions such as contributions to a 401(k) or pension plan. Relevant W-2 boxes are displayed to the side if they can be taken from the form. It is possible to use W-2 forms as a reference for filling out the input fields.

In order to find an estimated tax refund or due, it is first necessary to determine a proper taxable income.

0 kommentar(er)

0 kommentar(er)